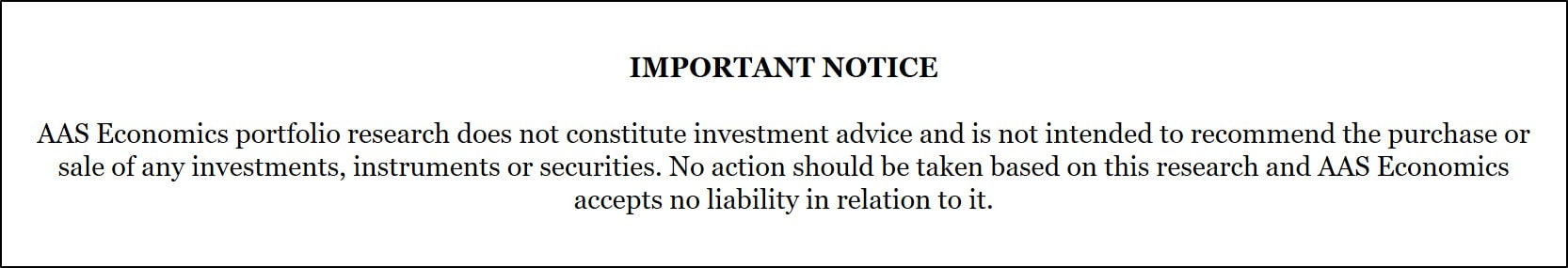

Our Systematic Portfolios

Our unique combination of monetary economics and econometrics allows us to apply our skillset in developing notional systematic portfolios, the performance of which we track over time. As we update these portfolios we publish them so that interested parties may see the applicability of our methodology.

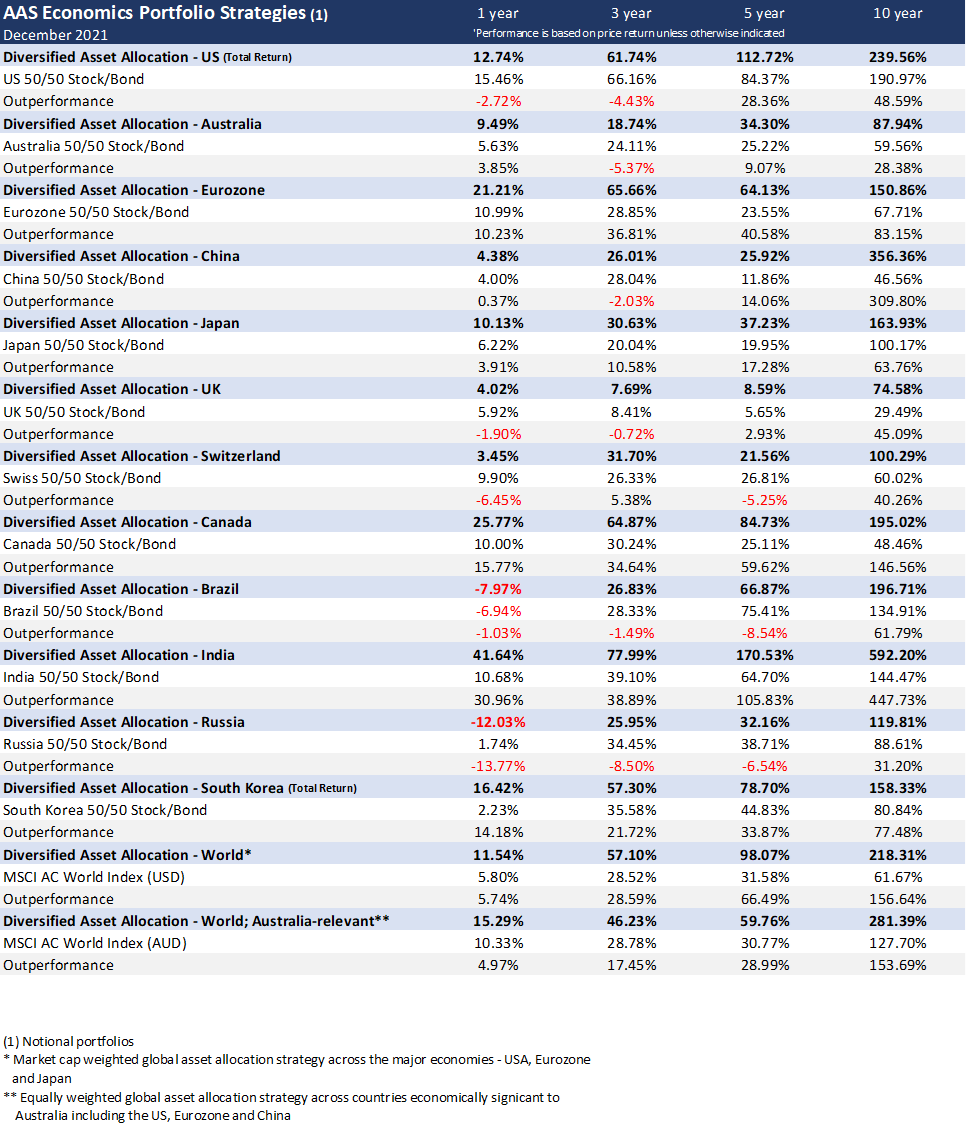

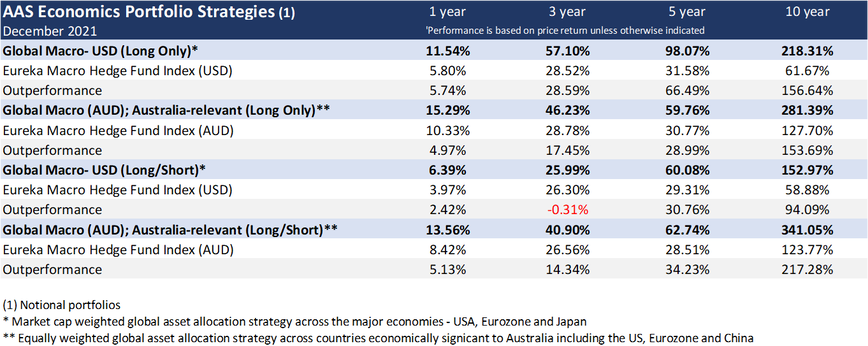

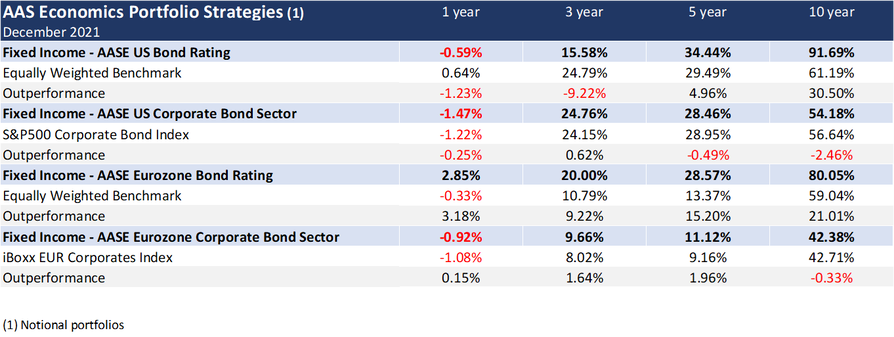

All portfolios are totally systematic and fully reflect our desire for replicability. We maintain over 20 different notional portfolios covering many geographies and asset classes and a selection of these portfolios is shown below. As well as our off-the-shelf portfolios we also develop systematic portfolios for clients based on their particular requirements.

Our portfolios are driven by economic data and are based on Austrian money and credit theory. As such they are systematic-fundamental rather than systematic-technical in nature.

Please feel free to contact us for further information about our systematic portfolios - and our customised portfolio services - and how these may be able to assist you in your investment decisions.

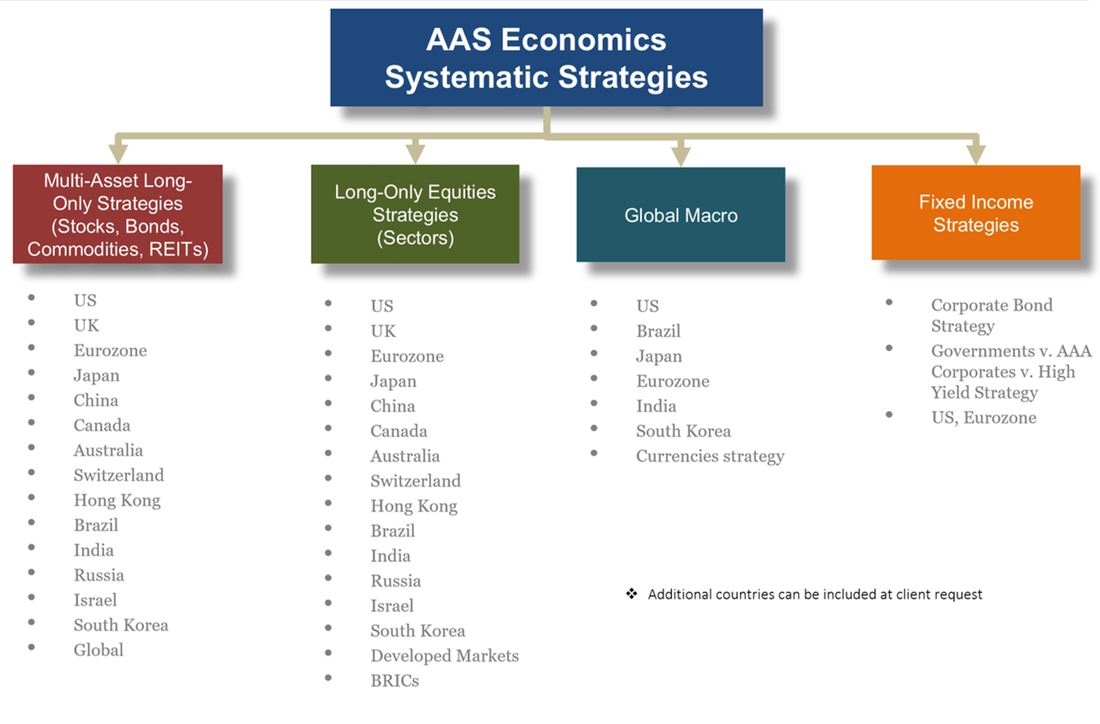

Systematic Portfolios

Returns vs Benchmark

% That Have Outperformed Benchmark

Different Timeframes

As at 31st December, 2021

* All Portfolios Notional

Equities

Multi-Asset

Global Macro

Fixed Income